A quarter of pre-retirees plunged into poverty by increased State Pension Age to 66

- Shocking findings show State Pension Age rise leaves a quarter of 65 year olds in poverty.

- 100,000 more people were pushed into poverty as State Pension Age rose to 66, but only 60,000 managed to work longer.

- Government should rethink State Pension policy to reflect near 20-year difference in healthy life expectancy between better-off and least-advantaged groups.

- State Pension Age review should consider more flexibility in starting ages to account for ill-health, disability, long contribution records or caring.

Shocking findings show damage caused by increased State Pension Age: The latest research released today by the Institute for Fiscal Studies, shows that the increase in State Pension Age to 66 has caused poverty rates for 65 year-olds to more than double. These findings are truly shocking, with the delay in their state pension starting age leaving one in four 65-year-olds in poverty. Even those with seriously shortened life expectancy and up to 50 years contributions to National Insurance, cannot receive a penny of State Pension early.

100,000 more in poverty while only 60,000 managed to keep working longer: While more 65 year olds did manage to stay in work, the numbers were far less than those plunged into poverty according to the IFS estimates. This clearly has a seriously negative social impact.

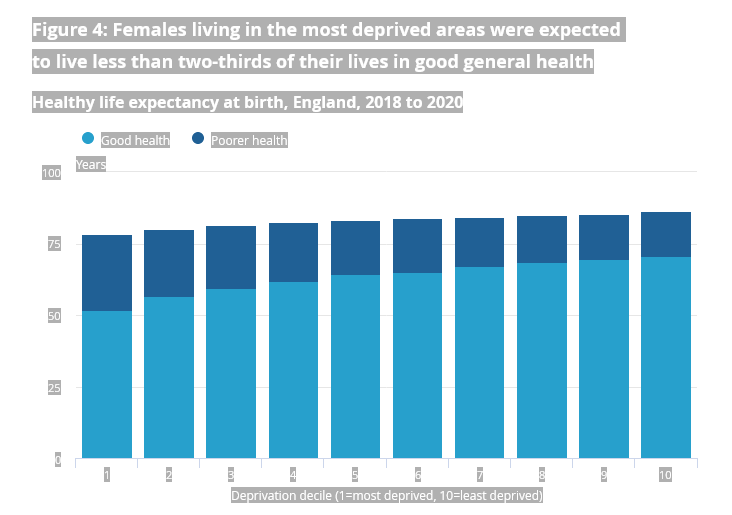

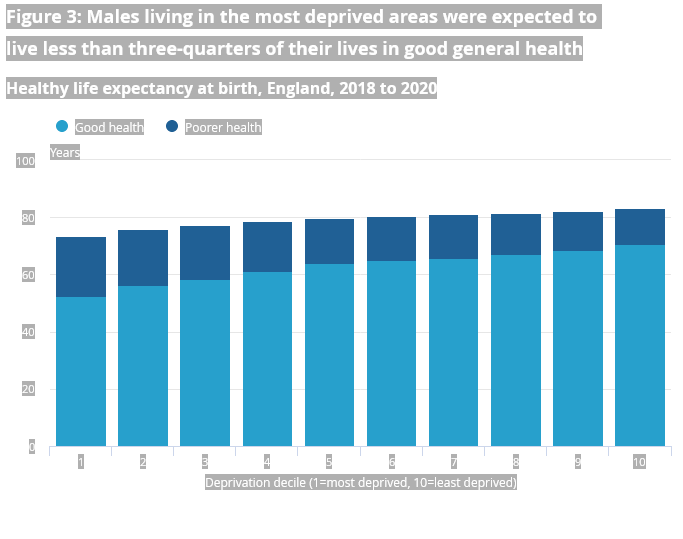

Just raising State Pension Age because ‘average’ life expectancy has increased is a blunt cost-saving tool creating additional hardship for the most disadvantaged groups: The scale of increased poverty caused by the rise in state pension starting age is further evidence that the blunt cost-saving tool of increasing state pension age increases social injustice. Forcing everyone to wait longer because average life expectancy has risen, ignores the near 20-year differential in healthy life expectancy across the UK. The least advantaged groups (bottom 10 percent) only remain in good health, on average, until around age 50, while those in the top 10 percent can expect to be in good health until around age 70. Average life expectancy masks an enormous difference across the UK as shown here.

ONS estimated healthy life expectancy at birth 2018-2020

| Least well-off areas | Better-off areas | Difference | |

| Women | Age 51.9 | Age 70.7 | 18.8 years |

| Men | Age 52.3 | Age 70.5 | 18.2 years |

Official Data showing healthy life expectancy can be found here: https://www.ons.gov.uk/peoplepopulationandcommunity/healthandsocialcare/healthinequalities/bulletins/healthstatelifeexpectanciesbyindexofmultipledeprivationimd/2018to2020

Least well-off rely most on State Pension, with little or no private pensions or savings: It is this same group with lowest healthy lifespan, who also tend to have less private pension or other savings and have had lower earning careers. While private pensions allow early access, people in poor health – especially women – generally have less private income to supplement their National Insurance retirement benefits, leaving those who cannot keep working increasingly at risk of poverty.

National Insurance pension system does not recognise health differentials: The delay in starting state pension clearly increases poverty for the less-advantaged groups. Many with shorter life expectancy may never receive any State Pension, may be forced to work despite failing health, or live on out-of-work benefits, as they wait longer for their State Pension start date. Many have had hard manual working lives which took a toll on their health and using average life expectancy particularly disadvantages such workers. Even if they have worked for 50 years or more, they cannot get State Pension early.

Allowing early access, even at a reduced rate, could offer a lifeline: Rather than the unrealistic reliance on out-of-work benefits, flexibility in state pension starting age is required. The pandemic has hit over-60s employment, and worsened many people’s health or forced them into caring for loved ones. Many may be unable to work again. The current system only has flexibility for those who are healthy and wealthy enough to keep working or wait longer than age 66. They can receive extra State Pension by delaying their state date, but no allowance is made for those in the poorest health, unable to work, to draw even a reduced amount sooner. This is about social justice, as well as social support.

These groups also being denied Pension Credit as rules have been tightened: The lower income, least healthy sixty-somethings have been neglected by policymakers in recent years. This group, especially the women, has suffered a series of disadvantages since 2010. They have seen a six-year rise in state pension age and, although they may get better pensions when they reach the ever-rising age after the 2016 new State Pension was introduced, those who are too ill to work can no longer claim Pension Credit as they were able to after 2010. The Government has also increased the Pension Credit starting age, so that the payments start at State Pension Age, rather than at age 60 as before. In addition, previous rules allowed any household with one member over state pension age to claim Pension Credit if their household income is below the means-test threshold, however the rules were changed in 2016 so that both members of a couple must have reached their State Pension age before they can claim. If one of the couple cannot work, but still is below age 66, then they are both denied Pension Credit.

State Pension Age review is a chance to reconsider State Pension age policy: I hope that the ongoing review of State Pension Ages will recognise the injustice associated with continuing to increase the starting age for pension payments, regardless of the hardship caused to already disadvantaged groups. Of course it is not straightforward, but it would be more equitable to use a band of ages whereby those who need it can access their State Pension (or at least Pension Credit) sooner, subject to minimum contribution requirements and other assessments.

Long contribution records and poor health or caring duties should be taken into account: Using length of contribution history and health status, alongside chronological age, would allow more to benefit from their past National Insurance contributions. Under the previous State Pension system, the lowest earners could continue to earn extra State Pension beyond the minimum number of years for a full Basic Pension, but the new system stopped that. It would make sense to consider replacing that lost extra pension by allowing those in poorest health, or with extra-long contribution history, to receive some State Pension early if needed. Levelling up should also mean ensuring the State Pension system works more fairly for the least advantaged and I hope the Government will give this urgent consideration.

3 thoughts on “A quarter of pre-retirees plunged into poverty by increased State Pension Age to 66”

Ros, I have previously written to Stephen Timms about this and had a gracious response. As you so rightly point out, it is not only the moving of SPA which has caused problems. The lack of direct communication meant that many made unsuitable decisions about retiring or taking redundancy from which it was difficult to reverse.It is the additional effects of further rule changes relating to pension credit and the reduction or even elimination of SP inheritance with no notice after 2016. Even if there was still some inheritance due, the widows had years longer to wait for it and bereavement benefits are also far less generous. Surely this cohort should have had some protection from further changes.

My wife falls into the category of having to wait until age 66 for her pension instead of the expected age 60. Many women who fall into this category will, of course, not made the necessary budgeting.

Would it not be possible to offer these women half their pension at age 60 until age 72, thus at least, allowing some income during the ages 60 to 66. This would have no extra cost to government and would mean that these pensioners would have some pension income. This would be entirely voluntary.

I’d be interested in any thoughts and whether it would be possible to put this proposal to the relevant persons.

I totally agree with your statement I too fall into the 60-66 bracket I’m 65yr old in January. I eventually gave up work at 58yrs became a carer for my mum who has recently passed. At 51yrs old I got breast cancer at 56yrs had all clear struggled getting work & also have Ramsey hunt syndrome. Paid full stamp for 49yrs. My husband now supports me he dosnt mind but I myself feel I should beable to get a reduced pension which is rightly mine we were so wronged plus I had no notification regarding my pension. My private pension I cashed & covered 2yrs wages.