Regulators have driven pension funds away from UK investment trusts – FCA needs to act urgently to stop this damage

- UK economic growth under threat as investment trust crisis damages investments in UK infrastructure, renewable energy and real estate projects.

- Chancellor’s Mansion House reforms want pension funds to invest more to boost key sectors, but new regulatory cost disclosure rules have driven investors out of UK investment companies.

- Since 2022, waves of selling have caused funding to dry up, as official guidance – derived from EU disclosure standards – which EU firms do not even use – has artificially inflated UK firm charges.

- Ministers must urgently intervene, as this ‘own goal’ damages market stability and UK competitive position, while the FCA and Investment Association blame each other.

- Investment trusts are 36% of the FTSE-AllShare, so weakness in this sector, partly caused by fictitiously high charges disclosure, has undermined UK financial markets, driving investors abroad.

Crisis in UK investment trust market hurts UK pension funds: Many pension funds have used investment trusts to gain exposure to important UK sectors such as infrastructure, small firms and renewable energy. UK investment trusts support key growth sectors of the British economy, but over the past year, they have been hit by huge waves of selling, driving discounts to record levels and making new fund-raising all but impossible. Investment Companies are a model that has been particularly successful in mobilising long-term capital to further the UK’s ambitions across energy, social and economic infrastructure. They have been around for over 150 years and are one of the jewels in our financial markets’ crown. Many pension funds, seeking to diversify their portfolios into alternative, less liquid investments, have relied on investment companies, but are now nervous of the market.

The Chancellor’s Mansion House reforms want more pension investment in UK infrastructure and net zero transition businesses, which would ideally be through investment trusts: Many pension funds could not achieve sufficient diversification if investing in individual projects directly, and they do not have specialist expertise. UK investment trusts have focussed on these specific sectors to raise capital for long-term investments, so using tried and tested investment trusts would enable pension funds to invest for the long-term with less risk. The UK investment companies sector is a highly innovative part of the global financial ecosystem, and a distinctively British success story. These are ready-made vehicles for exposure to alternative energy, infrastructure and housing projects, as envisaged by the Chancellor’s Mansion House Reforms, potentially alongside the LTAFs, once they are set up. Closed-end companies are more suited to patient capital than open-ended vehicles, as they do not have to sell underlying illiquid assets if a few investors need to withdraw capital. Unfortunately, because of the market crisis that has developed in the past year, some pension investors, including local authority pension funds, are losing faith in using UK investment trusts.

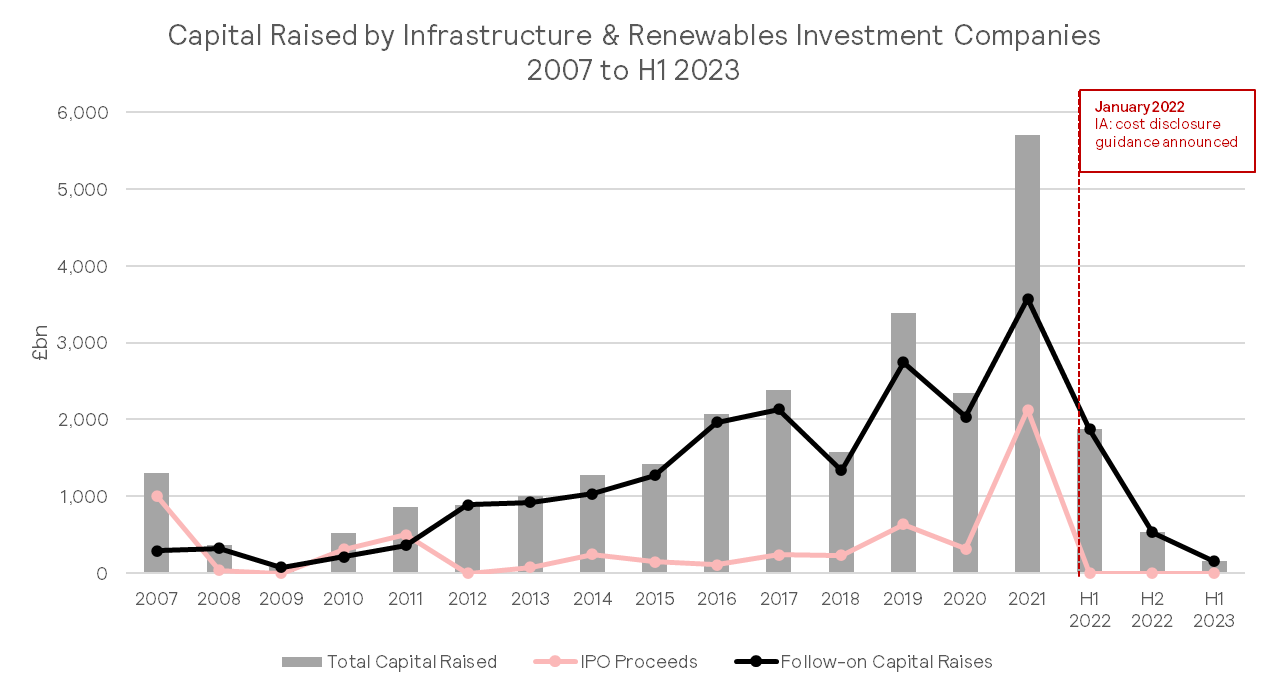

FCA has failed to act while the new charges disclosure adds to serious economic damage which needs to be urgently addressed as UK competitiveness and growth are at risk: This is not a small problem and has very real impacts for the UK economy. The Government’s Net Zero ambitions rely heavily on private sector funding, so ongoing problems are likely to materially impact our ability to meet decarbonisation targets. And this does not just affect clean energy, as major UK listed investment companies also focus on healthcare assets, logistics facilities, datacentres, schools, roads and the electricity grid. The current regulatory environment is starving these investments of capital, just as we need a mechanism for pensions and private sector assets to invest in attractive UK projects. There are tens of billions of pounds worth of unmet potential UK funding opportunities, as investment companies cannot raise capital due in large part to ill-conceived guidance which has compounded an already difficult UK equity market environment, especially amid rising interest rates. The chart below confirms the problem and shows it originated in 2022.

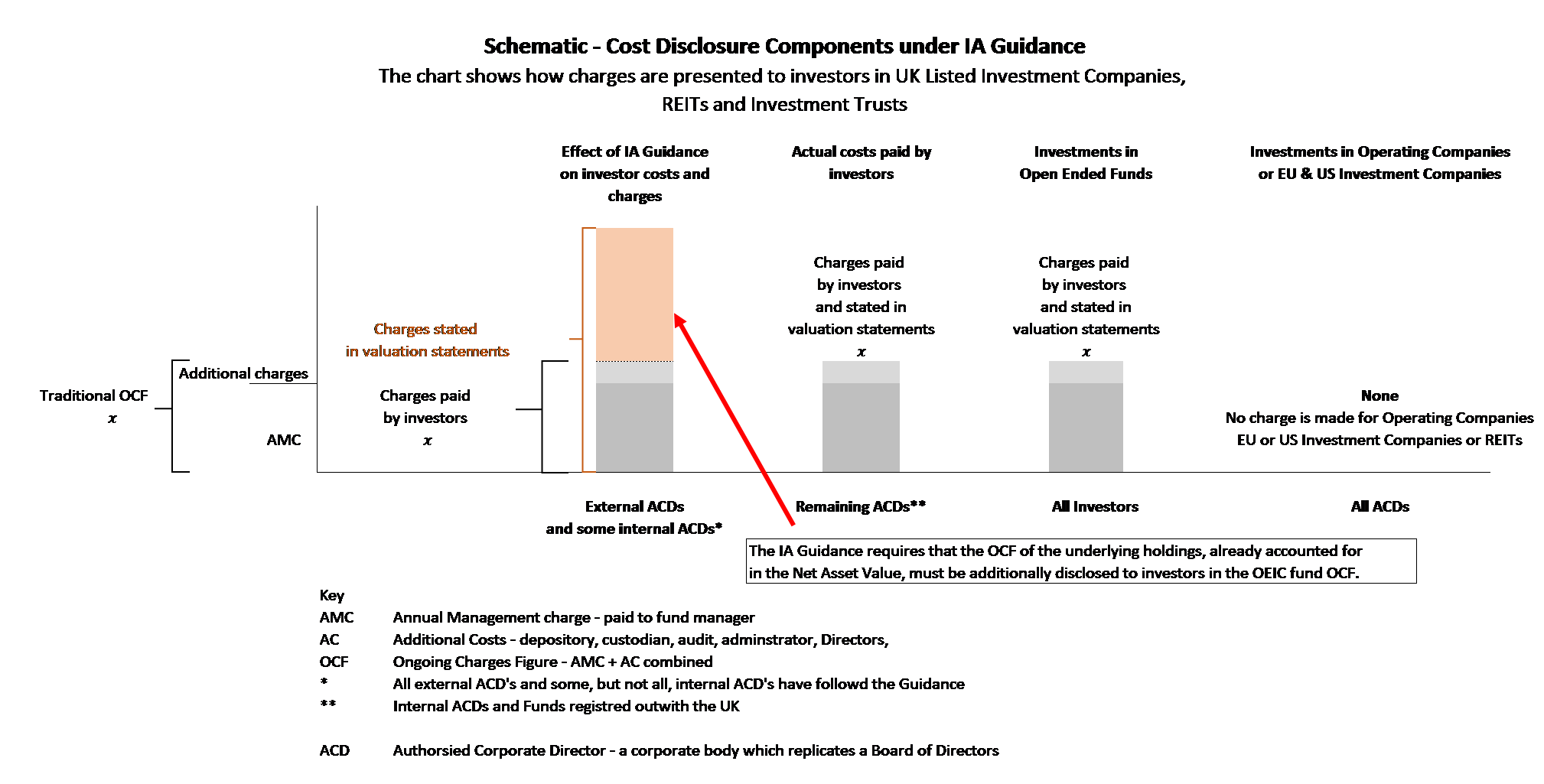

UK investment companies, unlike all global competitors, are being told to show exaggerated charges which make these UK funds look far too expensive: In 2022, the Investment Association issued new guidance, instructing investment companies to include so-called underlying ‘hidden’ costs in their charges disclosure documents. This is a unique interpretation of the EU’s MIFID regulations. The Investment Association says it has used wording from the FCA, while the FCA claims this is purely a matter for the Investment Association. This guidance originated in EU legislation but ONLY the UK is using it like this, despite having left the EU and despite the fact that the Government plans to drop this PRIIPs legislation anyway. This seems the opposite of what was supposed to happen after Brexit. Instead of dropping unnecessary EU regulations, we are uniquely adopting them to the detriment of our own companies. Baroness Bowles has highlighted this issue in the House of Lords several times and I am working with her and other industry experts to highlight the problem.

FCA and Investment Association have helped to undermine the competitive position of UK based investment companies: Due to a carry-over from EU cost disclosure rules (PRIIPS) which are not even used by EU based firms and which some larger companies are choosing to ignore, UK investment trusts have been rendered globally uncompetitive in charge comparison tables or in standard value for money assessments. Many comparison tables use the published high level charges figure, in which UK companies report around 1.5% annual charges, while the underlying and previous more realistic figure is around 0.75%. Investors who must operate within a 1% charge cap have been forced to sell these UK investment companies, which have also been dropped from from some comparison tables so they are being starved of funding. This ‘own goal’ is doing real damage, leaving many UK investment trusts at a severe competitive disadvantage. The impact is indicated in the chart below.

Managers of UK pension funds have confirmed this is a real problem: I have been liaising with some pension fund managers and here are some of their concerns. The charges disclosure guidance does not provide a like-for-like comparison between different types of underlying securities and has contributed to a long-term net outflow of capital from the sector, producing deep discounts. This restricts investment companies from raising capital and destroys the linkage between underlying asset value and shareholder returns. The longer this issue persists, the worse the potential outcome given its compounding and self-reinforcing nature. This is confusing for investors and undermines confidence in the sector. There is no shortage of alternative homes for capital in this space, the vast majority of which are based outside of the UK and would have negligible benefits for the UK economy.

Investment companies make up 36% of the FTSE-AllShare, so weakness in this sector undermines UK markets: The crisis in investment trust pricing, which has led to substantial share price falls and large discounts opening up, even though the underlying investments are doing well, has been another factor undermining UK financial markets, driving investors abroad. It is true that there are several factors that have hurt market sentiment for UK investments, especially in equity or perceived higher risk assets. Rising interest rates, negative macro-economic expectations and portfolio rebalancing towards bonds have not helped, but the impact of suddenly making UK firms look extremely expensive can only be detrimental. At the margin, it has certainly added to negative sentiment and, for some investors, it has been the major reason for selling, even at large discounts. Yet, this particular problem has been entirely artificially created by forcing only these UK firms to disclose charges in a misleading manner, while their competition – and some larger Investment companies which who do not follow the official guidance, have suddenly been handed unfair advantage.

FCA principles are being violated, so if FCA will not act, Ministers must intervene urgently: FCA principles require it to protect market integrity, promote fair competition and support the Government’s net zero objectives. In addition, it should ensure the market is operating in a manner consistent with international standards, taking account of rules in other jurisdictions, so that UK firms can continue to operate on a global basis. It also tells firms they must help consumers make properly informed decisions, with information that is clear, fair and not misleading. On each of these criteria, the current charges guidance which the FCA has allowed to remain in place, fails to uphold required standards. This is why, if the FCA does not urgently act by itself, Ministers must force this charges disclosure guidance to be withdrawn, pending a proper analysis of the sector and other countries. The FCA needs to announce publicly that it believes the 2022 IA guidance, which is only being followed by some in the market anyway, is not required and need not be followed, due to the adverse impacts on market stability and competitiveness. This change would put the UK back in line with the rest of the world, in what is an international market and help restore some equilibrium to this sector.