Banks should immediately cut record high credit card interest rates to 0.5% and reduce overdraft rates to help customers weather this crisis

Two suggestions for banks to introduce immediately to help customers cope with the current crisis.

- Reduce credit card interest rates to 0.5%

- Abandon plans to increase overdraft interest rates to nearly 40%

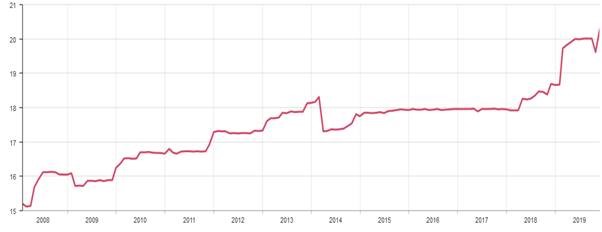

Credit card interest rates are at record highs, despite the bank rate at a record low: Credit card interest rates are higher now than they were before the 2008 financial crisis. Unfortunately, banks have been continuing to increase the interest rates charged to credit card customers, even as the rates they pay on their own borrowing have fallen to almost zero. During the current crisis, more and more consumers are going to have to rely on their credit cards for essential household spending, because they will have lost their jobs, or be put on zero hours contracts, or be waiting for Government help to begin, or are ill with the coronavirus. In these circumstances, how can banks justify charging record interest rates?

Credit Card Interest Rates

Interest Rate

Bank of England Statistics Quoted Household Interest Rates Table G1.3

Banks should immediately reduce credit card interest rates to 0.5% for 6 months: Given the huge bailouts that banks were given during the last crisis, surely it would only be right for them to help their customers in the current situation. As the Bank of England has slashed official borrowing rates, I would like to suggest that banks should dramatically reduce the record high rates they have been charging for the past years. For example, to help those who need to rely heavily on credit card borrowing to tide them through the current dislocation, banks might consider charging a credit card borrowing rate of, say, 0.5% for the next 6 months.

Banks should abandon plans to increase arranged overdraft rates to 40%: In response to Regulatory requirements for banks to reduce the interest rates they charge their customers for unarranaged overdrafts, which in the past have seen fixed charges result in interest rates higher than payday lenders, banks have announced that all overdraft borrowers, whether arranged or not, would be charged massive interest rates of around 40% per annum. Thus, those who borrow within pre-arranged limits are being penalised heavily, facing drastic increases in overdraft charges, and the rates seem unfair in the current environment. I hope that banks will reconsider these egregious charges, to help their customers weather the current storm. The self-employed, those who are away from work due to illness or isolation, or those waiting for benefit payments, will all need help in coming weeks. If they are charged such huge rates when trying to tide themselves over the current peak, then banks might be considered to be taking unfair advantage of the current situation.

Show leniency to customers needing unarranged overdrafts: Many customers will also find themselves in desperate circumstances unexpectedly. Nobody was prepared for the coronavirus lockdown measures or the business dislocation that has ensued. If they are forced to borrow to pay for essential supplies or services, it would seem only reasonable to ask banks, who were bailed out at huge public expense in the last crisis, to abandon plans to increase overdraft interest rates so sharply and ensure people can access borrowing at much lower rates than the 40% currently proposed, which represent extremely high cost credit, rather than reasonable commercial bank rates.

I hope people will support these suggestions, which could at least help ease the financial pain a little for many more people.

One thought on “Banks should immediately cut record high credit card interest rates to 0.5% and reduce overdraft rates to help customers weather this crisis”

Totally agree Ros and I’m surprised the

edict hasn’t been issued already. Without it’s unfair, unjust and unreasonable.