Emergency FCA action needed to prevent collapse of UK investment companies and boost pension fund investment in sustainable growth

Misleading cost disclosures are reducing investments in alternative energy and harming UK growth.

UK investment Companies are ready-made for kick-starting pension investment in sustainable UK growth, but FCA charge reporting rules makes them look high-cost, deterring new investors.

No more dithering and delay – Government should intervene now to ensure the FCA stops these inappropriate EU-derived charge disclosure rules being applied to UK investment companies.

FCA objectives to ensure fair competition, well-functioning, orderly markets, properly informed consumers and accurate charge disclosures justify emergency regulatory intervention.

- Pension funds and retail investors have been driven towards overseas investments which seem ‘cheaper’ than their UK equivalents even though they are not.

- Retail investor platforms have actually removed UK Investment Companies on a false premise – yet Regulators are not protecting investors from being misled about charges.

Specialist UK Investment Companies are ideal, ready-made vehicles for UK pension funds to use to kick-start diversification into sustainable growth assets: Most UK pension funds (and retail investors) do not have the specialist expertise or scale to build their own dedicated portfolios of alternative energy, infrastructure, property, sustainable energy or smaller companies themselves. However, the UK’s long-standing Investment Company sector offers an excellent, ready-made route for diversifying their asset allocation. Unfortunately, however, well-intentioned but misleading cost disclosure rules have made these companies look far more expensive than they really are, driving investors away and starving many good UK firms of much-needed investment.

Pension funds and other investors need help to invest in new sectors: How can investors invest in wind farms? Or build the knowledge to invest in small companies with good growth prospects? Those wanting to take advantage of the returns available from these sectors need collective investments and Investment Companies enable investors to access, through easily traded equities, a diversified pool of assets. Using a specialist Investment Company helps pension funds and other investors spread the risk, benefit from long-standing expertise and also allows them to sell the shares to access their capital if required.

Of course, fund managers charge fees to run such investment companies, so proper cost disclosure and transparency are important for investors: How much investors can expect to pay managers to select and manage good investments is vital information that needs to be clearly disclosed. Charges should be easy to find and completely transparent. The 373 quoted Investment Companies that are listed on the London Stock Exchange have to abide by UK company law which means they disclose all charges, including underlying fees, so that investors can decide what price to buy or sell the shares at. The rules are not meaningfully different from buying shares in large FTSE100 manufacturing firms but the London-listed Investment Companies are actually subject to greater levels of scrutiny and transparency than other listed companies or Funds. They publish detailed Factsheets, Key Investor Documents (KIDs) and Interim and Annual Reports, each of which discloses the running costs.

Although listed Investment Company costs are completely transparent and fully reported, FCA rules impose artificially inflated charge disclosures which mislead investors: Investment Companies calculate their costs within the independently verified Net Asset Value and then publish this figure in all of their documents. Unfortunately, however, these Investment Trusts, Unit Trusts, REITS and other quoted Investment Companies have been categorised as ‘Alternative Investment Funds (AIF)’. This inaccurate classification dates back to 2013, and means the UKs Investment Companies are regulated under the AIFMD (Alternative Investment Fund Managers Directive). In effect they have been lumped together with notoriously high-cost hedge funds and private equity funds which were often not disclosing all their costs to investors. As regulators imposed new rules designed to ensure such funds published their underlying running costs and all charges paid to the managers, UK listed Investment Companies were covered by this too. However, these additional charge disclosures were inappropriate, because, once the shares are quoted, the market price determines investor asset values and ongoing charges do not apply. But the additional disclosures required in recent years are used in the data feeds that populate all investors valuations, so the inappropriate cost aggregation misleads investors into believing Investment Company managers’ charges are extraordinarily high. This has contributed to continuous selling pressure, as investors or private wealth managers have come under increased scrutiny to lower investor costs. With few new buyers recently, this important sector of the UK market (comprising over 20% of the FTSE350, collectively managing c.£260bn) has been decimated.

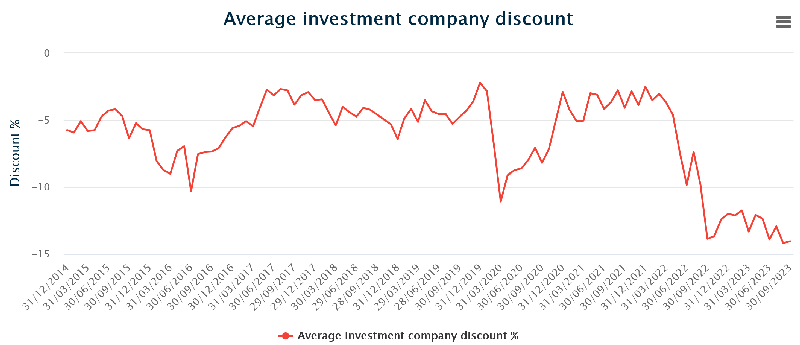

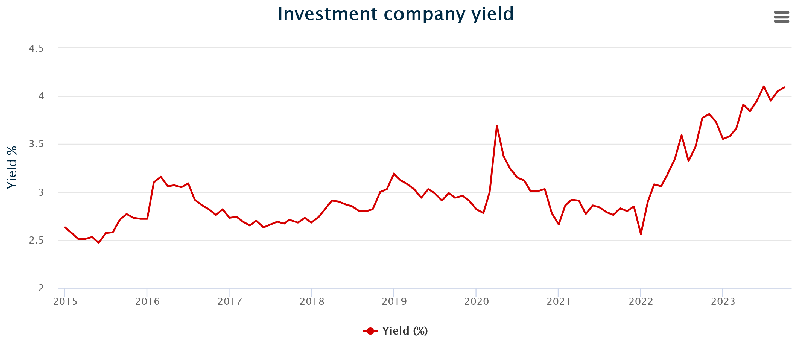

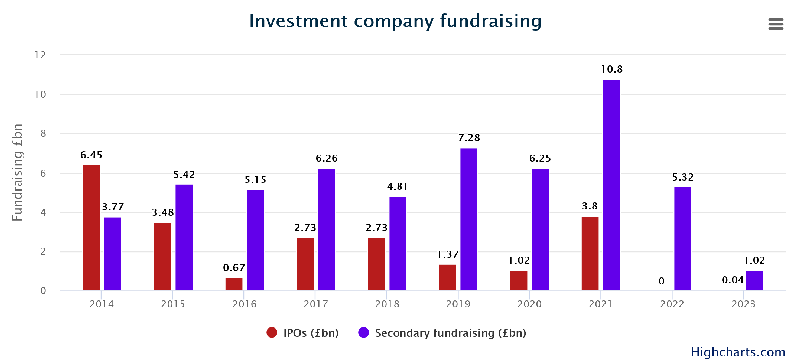

Market impact has left firms unable to raise capital: Selling pressure has driven Investment Company discounts and yields to multi-year highs (some are even offering double-digit yields), while new funding has dried up. The following charts illustrate the impact.

The FCA’s required charge disclosure rules suggest confusion about closed-ended Investment Companies: Closed-ended Investment Companies are different from hedge funds, private equity and open-ended investment companies (OEIC) or unit trusts which deduct costs from investor’s capital. With Investment Companies, once the investor has paid transaction fees to purchase the shares, any amounts charged by the managers or incurred by the underlying companies in the portfolio are factored by the market into the share price, rather than reducing investor returns. The costs of running the business such as management, legal or other fees, rent or raw materials should not be aggregated as if they are separate charges.

An example to highlight what is going wrong: Investment manager Gravis explains the situation it faces with its unitised UCITS fund investing in renewable energy. It holds large firms like SSE and also the quoted Investment Trust Greencoat UK Wind. Both companies invest in wind farms. Under current FCA guidance, Greencoat must report misleading costs such as legal, administration and manager fees, as if they are directly charged to investors, so Gravis has to add these supposed costs to its UCITS fund reported charges figure. By contrast, investing in SSE does not require that company’s underlying legal or other costs to be added to the Gravis Fund’s ongoing charges figure! Therefore, holding the Investment Company artificially inflates the unitised fund’s reported charges. Clearly, Gravis – and of course other such funds – are more likely to steer away from Investment Trusts such as Greencoat, in favour of other investments which do not exaggerate costs. The misleading information on charges is damaging an important market sector on the basis of a false premise. Such market dysfunction should have been acted upon, but the FCA has not intervened.

Share buybacks due to large discounts have reduced funds available for new investment in UK sustainable growth, risk overseas takeovers and deter pension investor support: The large discounts to net asset value have meant companies such as Greencoat cannot raise new capital from the market to invest in UK wind power. The company now plans a £100m share buyback, spending its cash to buy its own shares, rather than using it to invest in new projects that would enhance UK energy security. As long as this crisis for UK investment companies continues, with cost disclosure pressures driving investors away, more buybacks are inevitable, hampering the Chancellor’s aims of domestic investor and pension fund support for key growth sectors.

FCA must act to restore international competitiveness and market integrity: The UK is significantly out of line with international markets, but the FCA – with objectives including protecting market integrity and promoting international competitiveness – has failed to act as the crisis continues. Even though it is aware that several UK Investment Companies (notably index-tracking funds whose raison d’etre is offering low-cost investment vehicles) are ignoring the rules and are not aggregating those underlying costs, there is no intervention. Many specialist UK medium-sized and smaller Investment Companies, who stick to the rules, have been rendered uncompetitively expensive and lost investors on a false premise of being more expensive than others, including overseas-listed competitors who do not aggregate disclosed costs either. To promote fair competition, market integrity and international competitiveness, urgent FCA intervention is required.

FCA is even failing its own consumer duty rules by allowing retail investor platforms to mislead investors about charges: A number of UK listed Investment Companies are being excluded from investor platforms and buy-lists, as these platforms incorrectly tell investors they are far more expensive and wrongly show other funds being much ‘cheaper’. This has prevented investors from accessing UK-listed investment trusts selling at attractive discounts to long-term value and further distorts the market. Since the FCA is responsible for regulating investor platforms and knows this is happening, it needs to act quickly to protect consumers from being further misled. Currently, the FCA seems to be failing its new consumer duty that requires investor information to be clear, fair and not misleading.

No more dithering, nor more delay, the time to act is now: This situation is critical and requires emergency action to undo the harms that have been inadvertently caused to many of our great Investment Companies. Pension funds looking to invest in sustainable growth, alternative energy or infrastructure are being driven abroad, because UK companies appear unreasonably expensive. There is also a danger of overseas buyers snapping up our critical national assets (such as wind farms, solar farms, life science labs and so on) at knock down prices, increasing risks to future domestic energy supplies and further damaging UK markets and growth. I will be asking an Oral Question in the House of Lords at 2.30pm this Monday 13 November, challenging Ministers to intervene. No more dithering, the time to act is now.

5 thoughts on “Emergency FCA action needed to prevent collapse of UK investment companies and boost pension fund investment in sustainable growth”

Brilliant article and you can certainly publish my name saying so

Thank you, Max.

Superb points well made. As a long standing many decades supporter of unit trusts I really do want to invest in investment companies especially as discounts currently are attractive. I’m doing research now to look to invest in investment companies both for our clients and family.

Superb article and absolutely the right thing to push for as there is only upside for everyone including the key group – retail investors/consumers. Investment companies have stood the test of time and proved to be superb vehicles for retail investors for more than 150 years but risk being starved to death without the action you are advocating. Fingers crossed and a huge thank you.

I think you can make the relative cost of running the company more clearly, by pointing out the shares will normally trade at a discount to their Net Asset Value. In an efficient market for a trust that purely owns listed investments this will be the Net Present Value of future fees.

An easy way to think about this is if the manager of a trust doubles the fee of a closed ended fund would you expect the price to drop? The amount it should drop is not only this years fees, but the reduced return you will earn in future years.

Whilst the fees in an closed ended fund are by no means immaterial and should be declared clearly to investors, they aren’t the same as the other ongoing fees that have to be declared annually to investors in a managed portfolio. Apples and oranges really.