Rates are too low as economy booming – Forward Guidance looking backwards

14 November 2013

- Bank of England repeating past mistakes – rates should start rising as UK growth set to surge

- Mortgage borrowers enticed into large loans at low rates as loan to income ratio returns to pre-crisis peak

- Keeping rates at 0.5% is about politics, not economics

- Take the squeeze off pensions and savers – and encourage companies to spend their £200bn cash pile

- UK economy is booming – but BoE looking backwards instead of forwards:

The Bank of England has finally realised that the UK economy is actually performing well. All the forward indicators have been signalling strong growth for months now, yet policymakers and commentators have been failing to see the road ahead. Monetary policy has been steering while looking in the rear view mirror.

Forward guidance is looking backwards – Unemployment is a lagging indicator: The policy of ‘forward guidance’ is focussed on a backward indicator. Unemployment has always been a lagging economic indicator. Meanwhile, the leading economic indicators point to rising consumer spending, rising business confidence, rising construction activity, booming house prices and increased job creation. By the time unemployment falls to 7%, the economy will already have been growing strongly for some time.

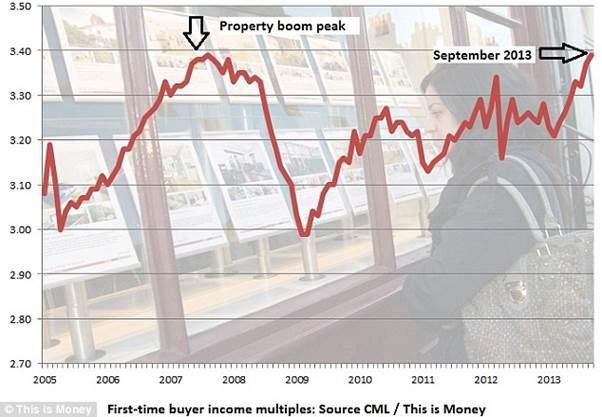

Repeating pre-crisis errors of encouraging unaffordable debt: Worryingly, many more people are being encouraged to borrow huge sums to buy homes at inflated prices, at multiples of salary that are back to the levels of the pre-crisis euphoria, but at interest rates that are clearly unsustainable.

Mortgage loans back to pre-crisis peak, house prices booming outside Circle Line too: The policies of Funding for Lending and HelptoBuy have stoked up a housing boom which has led to over-exuberance. Coupled with the billions of pounds of new money created by Quantitative Easing, the economy is being driven by debt once again. The ONS reports that house price inflation is over 4% in 10 out of 12 regions of the country and there has been an increase of 34% in first-time buyers coming into the market. They are borrowing a record 3.39 times their join £35,600 incomes, which equals the peak of the noughties boom – as shown in the chart.

If borrowers can’t afford their debts as rates rise from 0.5% to 1% then loans eventually will default anyway: One of the reasons given for not beginning to raise rates now is that people would be unable to afford to repay their mortgages. This is not a sufficient justification, certainly not now that the economy is motoring. Surely, if borrowers cannot afford their loans with interest rates moving up from 0.5% to, say, 1%, 2% or even 3%, then those loans are too large for them. Rates cannot stay at these levels for ever and the sensible move is to gently edge rates up from the emergency crisis levels.

Rates are at depression levels, rising from 0.5% is hardly ‘tight’ policy – more about politics than economics: Rates were cut to 0.5% in order to stave off depression. Given that the economy is clearly recovering, one has to wonder why rates are still stuck near zero. This seems much more about politics than economics. Prudent monetary policy would normally recognise that interest rates operate with a lag and, if growth is set to be strong twelve months out, rates need to start rising now.

Companies have £200billion cash pile – Chancellor should introduce tax breaks to encourage investment: Instead of keeping rates so low, the Chancellor should use his Autumn Statement to introduce temporary tax breaks for corporate capital spending. Companies have over £200billion in cash sitting on their balance sheets – that could help the economy achieve long-term sustainable growth, rather than fuelling more borrowing that will eventually have to be repaid or default.

Rates should normalise to stop pension funds and savers being penalised to support unsustainable borrowing: Keeping rates at 0.5% for so long is leaving pension funds and savers struggling to cope with interest rates that do not reflect economic reality. Pension deficits continue to hamper some companies unnecessarily, annuity rates are so low that millions of pensioners will be permanently poorer for decades to come and those who have saved for their future are still struggling as their income and capital is not keeping up with inflation.

Delaying rate rises is risking another crash: Come on Mr. Carney, you can rebuild confidence by signalling a small rise in rates to more normal levels, rather than leaving it too late. The longer a rate rise is delayed, the greater the risk of a sharp rate rise later and another crash.