Britain sinking deeper into debt as more consumers buy on high-interest credit

- Ultra-low interest rates are not feeding through to individual consumers.

- Since 2009, credit card lending now 40% higher and household non-mortgage debt up 52.6%.

- Average adult pays nearly £1000 a year in interest as retailers increasingly use buy now, pay later.

- 40% of working age people have under £100 in savings and are vulnerable to any economic weakness.

- Should Regulators curb unsecured borrowing at high rates given indications that we may be repeating mistakes that caused the financial crisis?

An analysis of recent statistics suggests the UK may be recreating conditions that led to the financial crash ten years ago. Far from resolving the problems caused by irresponsible borrowing and lending, the policies pursued since 2009 seem to have facilitated rising debt levels – both secured, and unsecured – in the UK household sector, as well as the public sector. Of added concern is that the interest rates on unsecured credit card debt and amounts lent have increased sharply, despite official interest rates being so low. Banks and financial firms have been rebuilding their strength, but financial resilience of UK individuals has been deteriorating. This is being further compounded by retailers using credit as an additional source of short-term profit, urging customers to buy now, pay later, without checks on affordability of interest payments

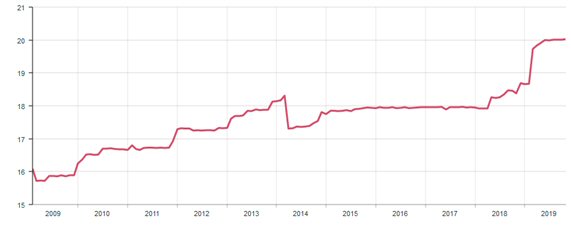

Rates charged on credit card borrowing at record high, despite low official interest rates: Credit card customers have not benefited from lower interest rates since the 2009 financial crisis. The Bank of England has cut interest rates to record low levels but credit card interest rates for individual borrowers are sharply higher than they were ten years ago. In 2009 they were around 16% and have now risen to over 20% as shown in Chart 1.

Chart 1: CREDIT CARD INTEREST RATES

Percentage

Source: Bank of England Household interest rates statistics, table G1.3

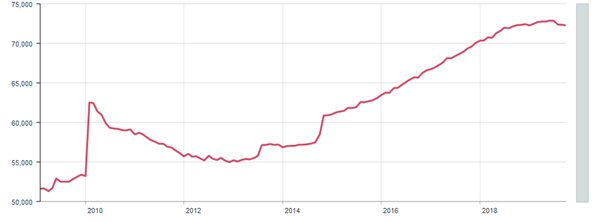

Amount borrowed on credit cards up 40% since 2009 as lenders entice consumers into debt: Despite these high interest rates on credit card lending, the amount people are borrowing has risen significantly, being far higher now than 2009. More people are buying on credit as overall UK debt has risen sharply. Individuals are sinking deeper into debt and may struggle to repay if economic conditions deteriorate. Worryingly, outstanding balances on credit card lending have increased from £51.6 billion in 2009 to £72.3 billion in 2019, a rise of 40% (see chart 2 below). This trend is likely to continue, especially as credit card companies are enticing people to take out more credit, offering unrequested increases in credit limits and few checks on their ability to repay. Retail firms are also encouraging more customers to borrow to pay for their purchases, with some firms making significant profits on this high cost credit. While employment levels and economic activity are quite healthy, this rising debt should be a cause for concern. Bad debts are already increasing and any economic downturn will leave more people struggling to pay their debts.

Chart 2: NET CREDIT CARD LENDING TO INDIVIDUALS, OUTSTANDING BALANCES – +40%

£billion

Source: Bank of England Household Interest Rate Statistics

Older consumers are increasingly using credit and more enter retirement in debt: In the past, older customers were more reluctant to borrow, but numbers of older people turning to credit cards is rising sharply too. In 2018, 37% of over 55s had credit card debts, while in 2019 that had risen to 54%. Total debt among over 55s has increased by 47% in the past five years alone.[i]

Average non-mortgage debt per UK household is 52.6% higher than 2009: The debts taken on by UK households did fall somewhat after the crash, but are now 52.6% higher than in 2009. Indeed, since the low in 2012, household debt is up 64%. Rather than repaying debt, households are taking on more borrowing, which leaves more of them vulnerable to any economic or financial shock. The table below shows debt levels per household (excluding mortgages)

Chart 3: AVERAGE UK HOUSHOLD DEBTS EXCLUDING MORTGAGE

Source: ONS

Other forms of consumer lending have also been increasing sharply in recent years: Straight after 2009, lending to households (excluding credit cards and student loans) was falling, which was a welcome development after the excessive debts that had built up before the crash. However, since 2013, lending has soared once more and is now well above the pre-crisis levels. In January 2009, non-credit card lending was £137.05bn (excluding student loans) but in September 2019 it was 11.5% higher at £152.8bn. Since 2013, it has risen over 50%. See Chart 4)

Chart 4: NET HOUSEHOLD LENDING (EXCL. CREDIT CARDS AND STUDENT LOANS) + £11.5%

£billion

Source: Bank of England Household interest rates statistics

Including mortgages, average household debt has risen 18.6% since 2009 risking slower growth: One might have hoped that the impact of rising household non-mortgage debt could be offset by the sharp fall in mortgage interest rates for homeowners. However, this is not the case. Rising house prices have driven up the total amount borrowed, so average household debt including mortgages is also higher (by 18.6%) than 2009. The UK is increasingly taking on more debt, rather than repaying amounts already borrowed. Borrowing today will normally mean having less to spend in future, it is bringing forward consumption, rather than increasing overall economic activity long-term.

Chart 5: AVERAGE UK HOUSEHOLD DEBT INCLUDING MORTGAGES

Source: ONS

Each UK adult pays nearly £1000 a year in interest: Total debt owed by UK households has risen to more than £1.5 trillion in 2019, and the Money Charity suggests the average amount of interest paid by each UK adult is estimated as £963 a year, or £1831 per household. The report also shows that borrowers paid £139 million a day in interest charges in July 2019. These are extraordinary figures, suggesting many people are already paying significant sums just to finance past borrowing and they may have to reduce spending in future to repay debt.

Concerns about UK financial resilience as 40% of working age people have under £100 savings: As the nation increases its reliance on debt, the financial resilience of the population and the economy has deteriorated. Rising borrowing must be repaid at some point, which will be a drag on future growth. A House of Lords report showed that 40% of the working age population have less than £100 in savings and one in eight adults have no savings at all. Therefore, many households are vulnerable to sudden unexpected spending needs, such as boiler or appliance breakdown, illness, job loss or theft. Borrowing for current expenditure does not create growth, it is effectively bringing forward tomorrow’s spending to today. When borrowing has to be repaid, living standards will be lower in the future. It is not possible to keep increasing borrowing indefinitely.

Regulators should consider the case for controls on credit card lending and interest charges: Rising levels of consumer debt and increasing reliance by retailers on profit from lending to customers, are worrying signals for the economy. The FCA and PRA need to investigate the rising level of credit card lending and high interest charges, with consideration of measures to prevent firms increasing credit limits without specific requests and also to assess the interest rates charged. Controls on unsecured lending and improved affordability assessment could be introduced, to help the financial resilience of the economy and households. An increase in savings rates and reduction in borrowing, as well as encouraging credit card lenders to ensure they pass on the benefit of exceptionally low interest rates to their customers, could help the economy’s growth prospects for the future.

Savings ethic has dwindled as interest rates are below inflation: While borrowing has risen sharply, the interest rates paid on savings accounts have fallen and have remained below inflation for most of the past ten years. This means cash savers are losing money on their savings in real terms. That itself may encourage more borrowing for current spending. The balance between savings and borrowing in the UK has been distorted somewhat.

Chart 6: INTEREST RATES ON HOUSEHOLD SAVINGS BALANCES UP TO 1 YEAR MATURITY

Percentage

Source: Bank of England Household Interest Rates statistic Table G1.3

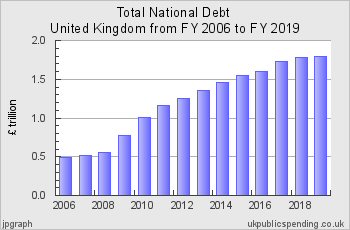

Public sector debt has risen sharply too: As well as rising household debt, total National Debt (i.e. public sector debt) has more than tripled since 2008, to around £1.8 trillion. So, while private sector household debt has risen sharply, Government debt has also soared since the financial crisis. Public sector borrowing may be considered less of a problem if it is used for investment that produces future growth. However, borrowing more to finance non-investment spending, helps today’s politicians spend money that future Governments and taxpayers will ultimately need to repay.

Chart 7: TOTAL NATIONAL DEBT TRIPLED SINCE 2008

CONCLUSION:

Regulators and policymakers should be seriously concerned about rising debt and falling financial resilience across the UK: Britain is suffering from a worrying increase in debt levels and the population is increasingly vulnerable to any economic shock. The culture of savings has withered away, while the borrowing culture has grown alarmingly. It is time for Regulators and policymakers to wake up to the dangers of ever-rising debt, the lack of financial resilience among the population and the enormous costs of interest payments (average £1000 per adult) that are already burdening the public. Controls on credit card lending and automatic credit limit extensions are urgently needed and it is time for attention to be paid to the increase in interest rates being charged to consumers by credit card companies. This applies to banks and other retail firms, which should be part of an official analysis of financial resilience.